Table of Content

An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.

Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H&R Block. A home equity line of credit, also known as a HELOC, is an open-end revolving line of credit in which the borrower uses their home equity as collateral. HELOC lenders create a lien against the borrowers home until the full amount is paid off, similar to a first mortgage. To apply for a HELOC, youll need to provide the lender with your personal and financial information. They will also verify the value of your home to ensure you have enough equity to qualify.

What types of mortgages qualify for the mortgage deduction?

However, in exchange for this benefit, there are new rules on what you can and can’t deduct when you pull out the equity. While you can use the money for anything you wish, you will need to use the money for home improvements to deduct the loan interest on your taxes. If you have owned your property for less than 10 years and choose to sell it, any financial gain made will be subject to capital gains tax of 25%.

However, for the portion of your balance being added in the cash-out refinance, you may do this only if you use the money to make capital improvements. Make sure the money is being used for capital improvements, then you can probably deduct the points off your taxes. Find out how much closing costs are if you refinance your home. If you have questions about the tax deductions you can take when you do a refinance loan, please talk to your tax advisor.

Closing Costs on Primary Residence Are Not Tax Deductible

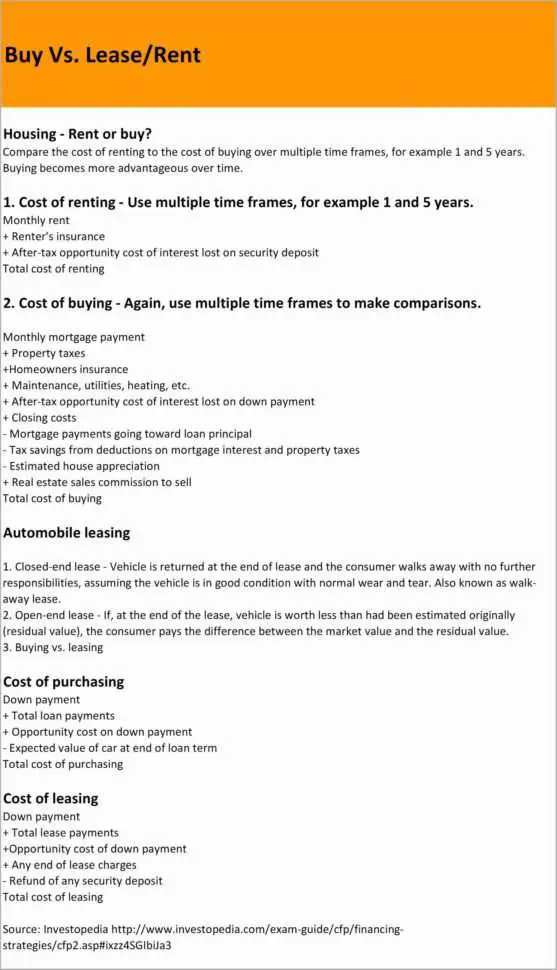

That's because the money you earn from a rental is considered taxable income. And the money that you spend to earn this income can usually be deducted from your rental income. Closing costs and settlement fees are not deductible on a primary or secondary home, but the rules for rental properties are different. The IRS considers rental income taxable on your annual return.

However, in exchange, many of the deductions homeowners could claim before are no longer available or are less substantial than before. For example, the Tax Cuts and Jobs Act lowered the cap on the interest deduction that applies to most mortgage loans. It also removed the insurance deduction on most mortgage loans. However, subsequent Congressional action restored the mortgage insurance premium deduction through the 2021 tax year.

Tax Deductions When Refinancing a Rental Property

Although it’d be handy if the Internal Revenue Service allowed you to deduct those refinancing fees, in most cases, they’re only partially deductible. Similar to a purchase mortgage, a refinance mortgage may require a borrower to pay points as part of the closing costs of the loan. The option to pay refinancing points or not to pay refinancing points could be left to the borrower to decide, and there are tax advantages and disadvantages to each.

Depending on how much lower your new rate is, you can save hundreds of dollars with each monthly payment. Or maybe you want to refinance to a mortgage with a shorter term. This can save you tens of thousands of dollars in interest payments over the life of your loan. Most closing costs can be deducted over the lifetime of your refinanced terms. If you refinance your mortgage to a term that’s 15 years, you can make deductions over the lifetime of that loan. However, there were changes to federal tax laws in 2017 with the Tax Cuts and Jobs Act that you should know about that may affect your tax deductions related to pulling out equity.

You can take advantage of these deductions via your annual income tax return. If you have multiple sources of income, you may want to consult with atax advisorto help you with your declaration. Remember, if you are doing a refinance for cash, the mortgage debt that you take out is only tax deductible if you are improving the home in a significant way.

You typically can’t deduct the total amount that you paid at closing the year that you refinance if you buy discount points. Instead, you must spread your deductions over the total course of your loan. For example, let’s say that you paid $5,000 at closing for discount points. Let’s also say that your refinanced loan has 10 years left on its term. You’d only be able to deduct $500 per year from your federal taxes.

For example, if you paid $15,000 for points on a 30-year loan, you would be able to deduct $500 per year. If you use the money for other uses – such as paying down credit card debt or covering a child's college tuition – you can only deduct the interest you pay on your loan's original balance. You can use this tax deduction for a home that is not your primary residence. This second home, though, must be listed as collateral for your refinanced mortgage.

Comments that include profanity or abusive language will not be posted. The lender that finances your home has a lien on your property. This means that if you fall behind on your payments, your lender can seize your property or put your loan into foreclosure. The information contained on RefiGuide.org website is for informational purposes only and is not an advertisement for products.

No comments:

Post a Comment